The existing tax rule allows an immediate deduction for assets up to a value of $500 noting that there are some caveats to this rule which we expect will also apply to the new $5,000 threshold: This comes at a time when many businesses may be investing in technology assets to ensure that employees are able to able to work from home if needed. The ability for businesses to claim immediate deductions for low value assets up to the value of $5,000 will be a welcome incentive to invest in assets. We discuss each of these measures in more detail below.

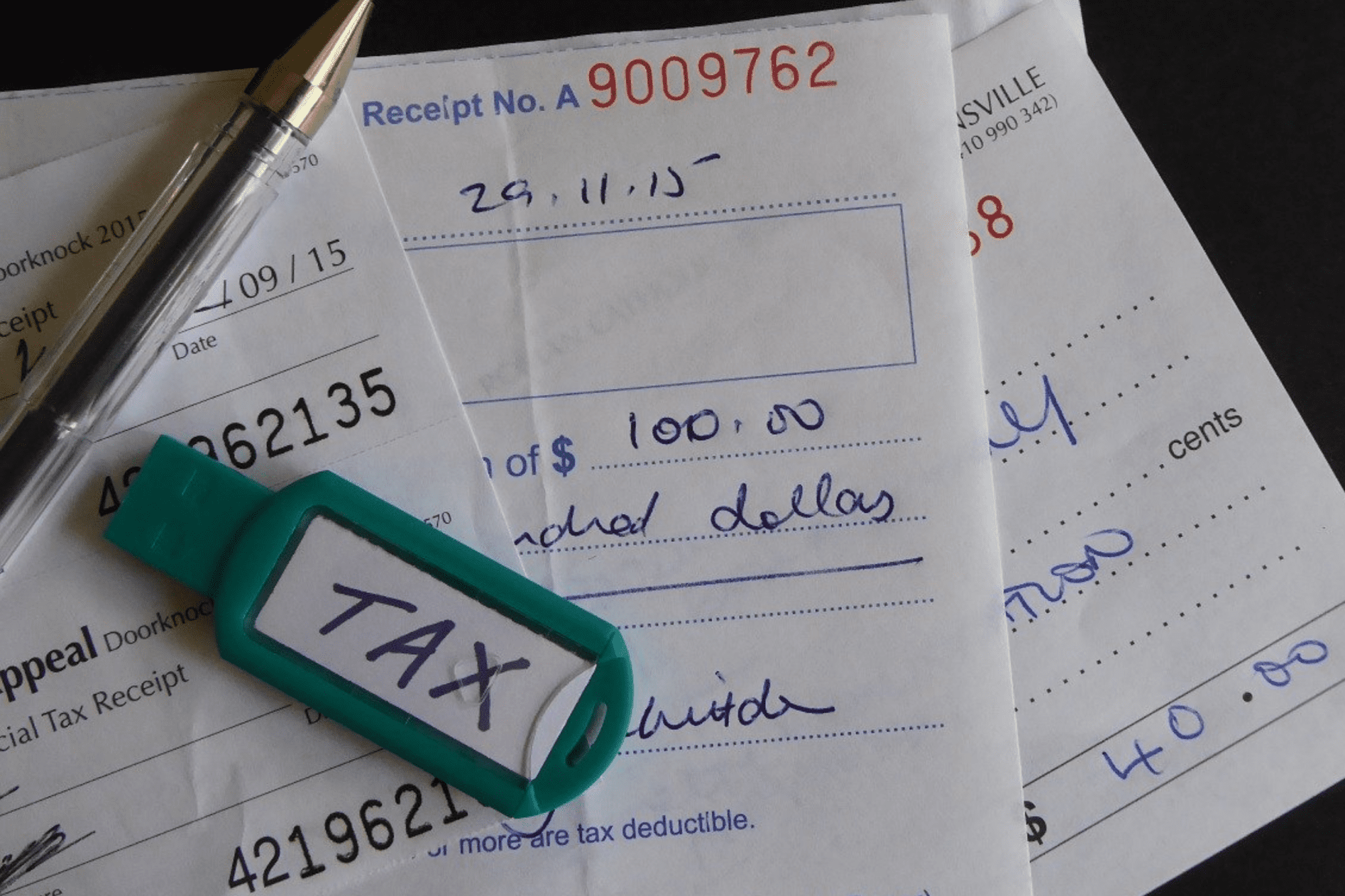

Increase in the threshold before provisional tax applies from $2,500 to $5,000 from the 2020/21 income year.Ability to apply for use of money interest write-offs for tax debts post 14 February 2020, if they are due to COVID-19.Allowing broader access to refunds of Research and Development Tax Credits in the 2019/20 income year.Reintroduction of depreciation on non-residential buildings at the rate of 2% diminishing value and 1.5% straight line from the 2020/21 income year (beginning 1 April 2020 for standard balance date taxpayers).The ability to take an immediate deduction for any assets costing $5,000 or less from 17 March 2020 this threshold will reduce to $1,000 on 17 March 2021 (noting the current threshold is $500).All of the tax changes were included in the COVID-19 Response (Taxation and Social Assistance Urgent Measures) Act 2020, which was introduced and passed through Parliament on 25 March 2020. Included within the package were a number of tax initiatives which will provide some relief to taxpayers. The largest element of the package is the delivery of wage subsidies to businesses and the delivery of support for essential services workers needing to self-isolate, delivered through the Ministry of Social Development ( more information on the subsidies is available here). On 17 March the New Zealand Government announced a substantial $12.1billion business continuity package aimed at assisting businesses through the COVID-19 situation.

0 kommentar(er)

0 kommentar(er)